Articles

Business Intelligence

Selling to Today’s Buyers

Thriving in the era of e-commerce and educated customers

January 21, 2016 By ODL

Jan. 21, 2016 – Something new is happening in the window and door industry: By the time a buyer gets to the dealer, they often know what they want. This is the result of an Internet-savvy market. Buyers familiarize themselves with product information on manufacturers’ and dealers’ websites, consult peer review and pour over discussion forums. In turn, manufacturers and dealers have been challenged with responding to a much-altered sales process.

Few have responded to this shift, though, passing up the opportunity to put systems and offerings in place that cater to this more-educated buyer. The good news: Today’s buyers feel more confident in the economy and want to put money back into their homes, making this a great time for dealers to win business.

This White Paper will help clarify who today’s buyers are and provide insights into how to sell to them.

WHO ARE OUR BUYERS?

This should come as no surprise: The largest share of our buyer pool is baby boomers. Born between 1946 and 1964, members of this generation are known for being adaptable, ambitious and independent. While they’ve put fewer dollars toward the window and door industry in recent years due to a shaky economy, they’re now back in full force. Sphere Trending, Waterford Township, Michigan, an organization that studies trends related to consumer needs, notes that baby boomers currently account for approximately half of all consumer spending.

What might come as a surprise, then, is that baby boomers are quickly making way for millennials. Millennials are not the customers yet, but they will be – and fast. Born between 1980 and 1997, members of this generation are known for being tech-savvy, social and ready to lead. Millennials have previously had little buying power due to high college tuition debt and lower income levels. Their financial situation is changing, however, and they’re now willing to spend on certain kinds of luxury.

As a result, millennials are influencing baby boomers in profound ways – what they buy, how they buy it and how demanding they are. As BUILDER magazine said, millennials are “the first generation that is aggressively challenging the home building industry to listen to their needs, rather than accept a housing stock that does not reflect a modern lifestyle.”

Baby boomers are quickly following millennials’ lead. For example, baby boomers have long purchased couches the “old way” – putting in an order with a furniture store and then waiting out the two or three months until delivery. Millennials are used to the “new way” – picking out a couch in a store or online and then waiting just a few days until delivery. Baby boomers are seeing the new ways’ merits and adopting it. Zooming out, baby boomers are adopting all sorts of “new ways” that millennials have demanded in the buying process – phone apps, peer reviews, customizable products, etc.

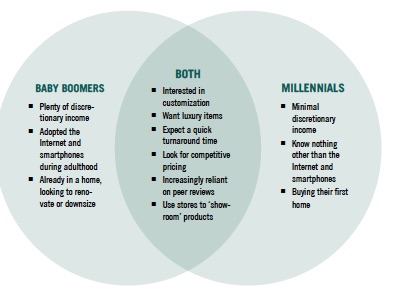

Resultantly, these two generations begin to overlap in terms of buyer type. Baby boomers and millennials exhibit slight differences, but as time goes on, it’s increasingly important that manufacturers and dealers understand their key similarities:

HOW DO WE SELL DOORS TO THESE BUYERS?

The answer takes the form of multiple steps.

Step 1: Understand the impact of the Internet The retail landscape has shifted. Joe Morin, vice president of sales & marketing, El & El Wood Products, Chino, California, says, “The Internet drives the sales process now. It used to be that the dealer would lead people to displays and start the conversation. Now, people come in and ask for a specific product. They’ve already done their research and they’re already decided.”

Chino, California, says, “The Internet drives the sales process now. It used to be that the dealer would lead people to displays and start the conversation. Now, people come in and ask for a specific product. They’ve already done their research and they’re already decided.”

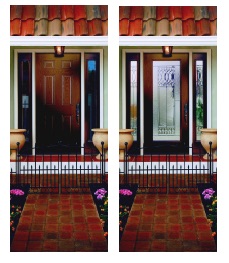

Step 2: Understand that curb appeal is a fashion business The front door is a homeowner’s brand and there is a multigenerational shift toward stylized, individual brands. If three options were typical before, now it’s 30. Even better, a buyer can weigh in on the design and have something unique – something that reflects their home and individuality. Sellers who recognize this trend and offer matching products and services will stand out.

Sellers must also recognize the move toward contemporary designs. Brent Moss, founder of Codel Doors, Tacoma, Washington, says, “We stay keen on trends. I know we think of the younger generation as desiring contemporary doors, but spec builders are also opting for them. And not for beginner homes! For older generations.”

When a homeowner is then ready to leave their home, the front door continues to play a role. As Moss notes, “When people are looking to buy your house, the front door is the first thing they see.” As baby boomers downsize and millennials buy, it’s a particularly good time to offer the products everyone wants.

Step 3: Embrace and leverage the shifting point of first contact Different buyers have different first points of contact. This is not generational, necessarily, but locational. For suburban and rural buyers, the first point of contact will be showrooms, often big-box stores. For shoppers in larger metro areas like NYC, D.C., Chicago and Los Angeles, less access to big-box-stores translates to an online first point of contact.

Regardless, buyers want to see a door before purchasing. Moss says, “It’s hard to order a door online. You really want to see it – get a sense of it.” Dealers must anticipate which customers will first look online and which in stores, and provide the tools, displays and information needed to give them a sense of the product.

Step 4: Optimize buyers’ showroom experience Brick and mortars must offer points of interaction that go beyond the usual door display and signage. Today’s buyers demand more than a nice pamphlet and two samples on the floor. Dealers should speak in the buyer’s language by using technology. Interactive displays engage and educate buyers. For example, a 3D visualization tool allowing the buyer to see how various styles of a product fit in their home improves both the customer’s buying process and the dealer’s selling process.

Step 5: Step up your online game for everyone, while still considering those shoppers looking online first Since the majority of buyers use the Internet to learn about products, dealers must have current, user-friendly websites. The most successful websites are simple and concise. Gone are the days of page-long letters from the founder describing the company history. Having less text on a page and fewer pages provides a more enjoyable experience. Hi-resolution photography displayed cleanly grabs the buyer’s attention and conveys that a company is progressive inside and out.

Step 5: Step up your online game for everyone, while still considering those shoppers looking online first Since the majority of buyers use the Internet to learn about products, dealers must have current, user-friendly websites. The most successful websites are simple and concise. Gone are the days of page-long letters from the founder describing the company history. Having less text on a page and fewer pages provides a more enjoyable experience. Hi-resolution photography displayed cleanly grabs the buyer’s attention and conveys that a company is progressive inside and out.

Customers don’t stop with a company website, though. They turn to social media and peer review platforms, adding another layer to the buying and selling process. To exceed in the marketplace, dealers must develop a social media presence and encourage interaction on websites like Houzz, Pinterest and Facebook. Monitoring consumer reviews on websites like Yelp and Google+ offers dealers two additional opportunities – responding to positive comments with appreciation and addressing discontent – both of which improve a company’s reputation.

Simple websites and a streamlined social media strategy help counter the difficulty of abundance. The marketplace becomes more crowded each day. When buyers look online, it’s easy to get lost in how much information is offered and how many products there are. A solid online presence streamlines the decision process and helps buyers find the right solution.

Streamlining the decision process is as simple as using recognizable language. Using industry-standard names for styles and products helps visitors navigate a website and find what they’re looking for. That means if visitors call a certain style “modern,” call it “modern.” Seeing the known and predicted terminology helps a readership that mostly skims. Removing all unnecessary details, both in terms of content and how it’s presented, further streamlines a website.

Step 6: Compete with Amazon, Overstock, Wayfair and so many other venues There’s a lot at stake here. Amazon and other venues can respond to buyers’ wants in buyers’ language. If dealers can’t respond in kind, these venues will overtake the industry.

To compete with them, dealers must offer something they can’t – something that educates. Dusty Dvorak, vice president, Taylor Door-Waudena Millwork, Schofield, Wisconsin, says, “Having a robust website with an interactive, custom configurator makes it easy for people to pick out options. Likewise for an in-person experience, a life-size TV monitor that shows options has been a real game-changer for us. We’re putting these in every retail lumberyard that supports us.” Competing with Amazon and other venues thus becomes a challenge of offering not just a product list, but knowledge, insights and service.

Selling exclusive designs is another way to compete. If a buyer can’t find the desired items on Amazon, Overstock, Wayfair or other e-commerce venues, they’ll look elsewhere.

Finally, as the saying goes, if you can’t beat the enemy, join them. Dealers can find rewarding partnerships with e-commerce venues.

Step 7: Meet demands that are difficult to meet – or avoid them Today’s buyer wants everything now. Dvorak says, “People just won’t wait anymore. They want it fast. People used to wait six weeks for decorative glass. Then it was two weeks. Now, if you don’t have the style they want, they go find something else at a big-box store. We’re seeing that buyers’ decision- making is increasingly based on lead time.”

To avoid the pressure to speed up, manufacturers and dealers must offer custom items. If there’s one thing people are willing to wait for at this point – and that’s a true if – it’s custom items that cannot be found anywhere else. The alternative, of course, is to speed up and meet buyers’ needs.

Another need manufacturers and dealers must meet or avoid: green. Moss says, “Green has been coming up for years now. People like to advertise green. Home Depot wants you to be green. In the end, though, people just care about price and how the product looks.” This sentiment is echoed throughout the industry: consumers express an interest in green products, but then don’t put the money behind that interest.

Buyers will, however, put money behind products made in the USA. Moss says, “If you can say ‘Made in the USA,’ it carries some weight. At least more than being green does!”

WHERE WE GO FROM HERE

Whether a millennial or baby boomer is the customer, and whether they’re looking to renovate or purchase newly, today’s buyer is educated and looking for a personal touch. That personal touch will manifest itself in the selected style, and perhaps in the sales process itself. Today’s dealers have a big challenge ahead with e-commerce, but it’s also a big opportunity.

Whether a millennial or baby boomer is the customer, and whether they’re looking to renovate or purchase newly, today’s buyer is educated and looking for a personal touch. That personal touch will manifest itself in the selected style, and perhaps in the sales process itself. Today’s dealers have a big challenge ahead with e-commerce, but it’s also a big opportunity.

The key to taking that opportunity is to not lose baby boomer customers while also staying ahead of the curve in appealing to millennials, because soon they will be the market. For both generations, dealers’ approach should ultimately be about education. If today’s buyers are educated, they’re getting that education from someone. Dealers must work to be that someone. Provide buyers with quality information in a way that inspires and excites. What follows will be a customer base that is satisfied and loyal for years to come.

For more information

www.odl.com

Print this page

Leave a Reply